Bubalus Resources (ASX: BUS) just released a technical update that, at first glance, might look like one for the rock nerds.

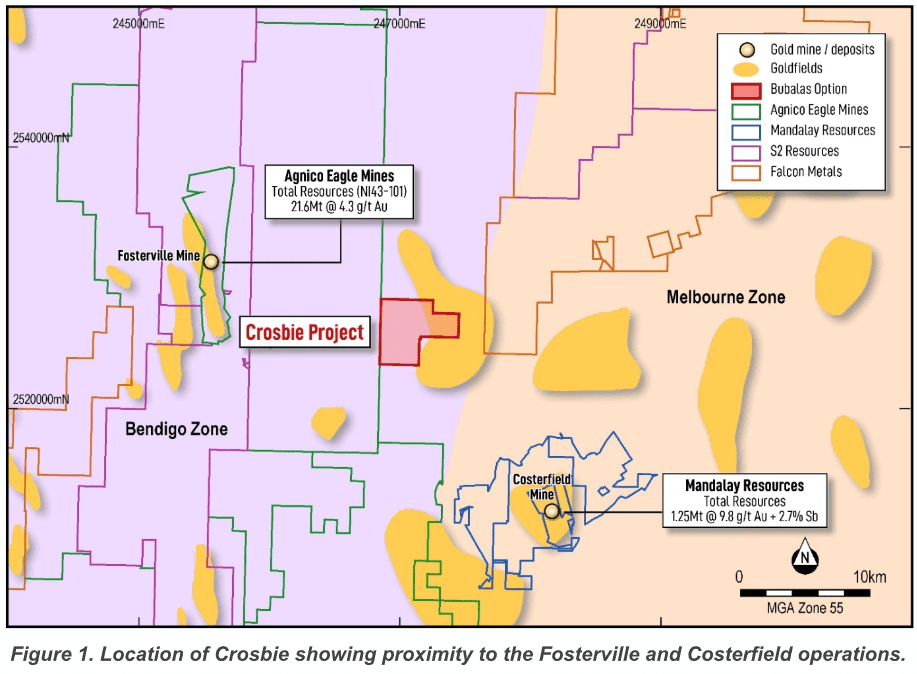

But dig into the details and something significant emerges. At Crosbie North, just 15 kilometres from Fosterville, BUS has identified targets that look remarkably similar to the geological signatures found at Australia’s most profitable gold mine.

At 9.1c with a tiny market cap of just $6 million and $4 million in the bank, BUS is entering the second half of 2025 with plenty of cash and near-term drilling of what looks like a high-potential target.

With a ~1000m drill campaign this quarter, investors should start to get excited. BUS sits in that sweet spot where good news can move the needle fast. And this could be very good news indeed.

Drill-Ready Gold Targets Emerging at Bubalus’ Crosbie North

Explorers often use a method called induced polarisation (IP) to peer underground without breaking the surface.

Think of it as a geophysical X-ray – electrical currents get passed through rock, and the response tells you what might be hiding below. Some minerals light up more than others, especially the ones that often host gold.

That’s what happened at Crosbie North. Bubalus ran five new IP survey lines and picked up strong signals starting around 190 metres below surface. These signals followed folded rock layers and fault lines – the same type of structures that often host high-grade gold in Victoria.

“We will now move rapidly to drill testing these compelling Fosterville style metasediment hosted targets”

– Bubalus Resources Managing Director Brendan Borg

Some of the responses were two to five times stronger than background levels, a strong indicator that something’s going on down there.

Adding weight to the story, earlier surface sampling returned up to 12.1 grams per tonne gold and 2.02% antimony, and these results sit right above the most promising IP targets.

When you get geochemistry, geophysics, and structure all pointing to the same spot like this, it usually means one thing. It’s time to drill.

Bubalus’ Crosbie North Sits on Fosterville-Style Gold Geology

When a junior explorer name-drops a nearby Tier 1 mine, it usually comes with a heavy dose of scepticism. Just being down the road doesn’t mean much on its own.

But Crosbie North is different. It doesn’t just share a postcode with Fosterville – it shares the same folded and faulted Castlemaine Group rocks, the same structural patterns, and now, the same kind of geophysical signals.

Fosterville is Australia’s largest high-grade gold mine and one of the world’s lowest-cost producers.

Owned by Agnico Eagle, a $91 billion company, it’s produced over 4.4 million ounces and remains a global benchmark for modern underground gold mining.

The signals detected in Bubalus’ recent survey align with the depth and direction of gold-bearing structures at Fosterville’s richest zones, known as Eagle and Swan. (A nice nod for fans of the 2005–06 AFL seasons)

There aren’t many small-cap explorers with this kind of geological and structural similarity to a Tier 1 asset, let alone one just down the road.

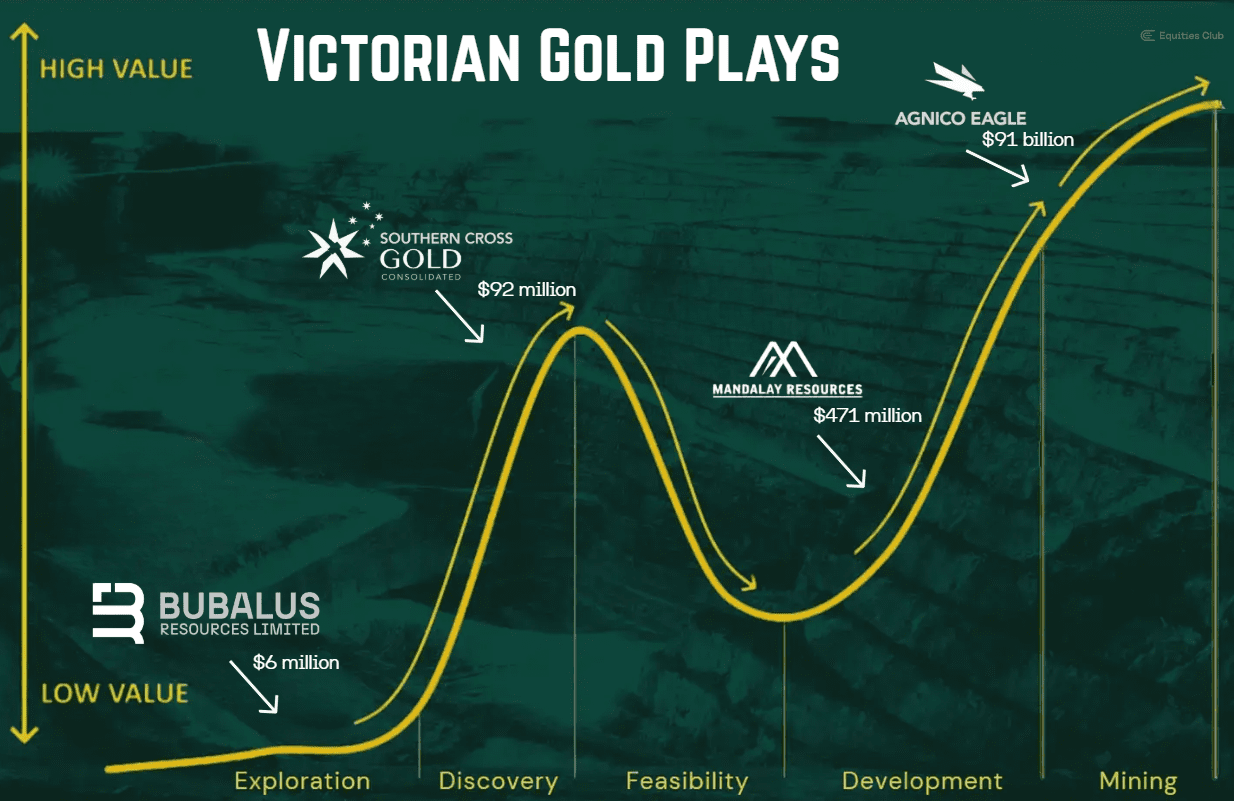

A Small-Cap Gold Stock with Big Discovery Potential

At a $6 million market cap, BUS trades like a typical early-stage explorer. But sitting 15 kilometres away is a $91 billion operation extracting gold from remarkably similar geology.

The market hasn’t priced in much value for these targets yet. This is the part of the curve where serious upside can be captured if the drill bit confirms what the modelling suggests.

If Crosbie North delivers anything close to what the geophysics is hinting at, BUS is set up for a significant rerate. With drilling starting this quarter, that could happen sooner rather than later.

BUS has a drill-ready target in one of Australia’s premier gold addresses, backed by multiple layers of evidence. Now it’s time to test whether the geology delivers what the data suggests.

Drilling Imminent at Bubalus’ Crosbie North Gold Target

Drilling starts this quarter at Crosbie North, and the pieces are falling into place. BUS has the geology, the geophysics, the cash ($4 million), and now the targets to test whether this Fosterville comparison holds up.

At 9.1 cents and a $6 million market cap, there’s not much expectation built into the share price. But with ~1000 metres of drilling about to test targets that look remarkably similar to one of the world’s best gold mines, that could change quickly.

The market will find out soon enough whether BUS has found something worth getting excited about.

General advice warning

The contents of this document are intended to provide general securities advice only and have been prepared without taking account of your objectives, financial situation or needs. Because of that you should, before taking any action to acquire or deal in, or follow a recommendation (if any) in respect of any of the financial products or information mentioned in this document, consulting your own investment advisor to consider whether that is appropriate having regard to your own objectives, financial situation and needs. If applicable, you should obtain the Product Disclosure Statement relating to the relevant financial product mentioned in this document (which contains full details of the terms and conditions of the relevant financial product) and consider it before making any decision about whether to acquire the financial product. Whilst the Equities Club Pty Ltd (“Equities Club”) believes information contained in this document is based on information which is believed to be reliable, its accuracy and completeness are not guaranteed and no warranty of accuracy or reliability is given or implied and no responsibility for any loss or damage arising in any way for any representation, act or omission is accepted by Equities Club or any officer, agent or employee of Equities Club or any related company.

Neither Equities Club, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice.

Disclosure

The directors, authorised representatives, employees and associated persons of Equities Club may have an interest in the financial products discussed in this document and they may earn brokerage, commissions, fees and advantages, pecuniary or otherwise, in connection with the making of a recommendation or dealing by a client in such financial products. Equities Club owns 450,000 shares of BUS at the time of publishing this article. Equities Club has been engaged by BUS at the time of writing.

Confidentiality notice

The information contained in and accompanying this communication is strictly confidential and intended solely for the use of the intended recipient/s. The copyright in this communication belongs to Equities Club. If you are not the intended recipient of this communication please delete and destroy all copies immediately.

Equities Club Ltd (CAR No. 001308139) is a corporate authorised representative of ShareX Pty Ltd, Australian Financial Services License (AFSL) No. 519872.