Bubalus Resources Articles

BUS Share Price & Investment Performance

Investment Summery

- Date of Investment Announcement 12th December 2024

- Entry Price $0.115

- Returns from Entry +21.7%

- High Point +56.5%

Company Milestones

- Initial investment: $0.115

- Stakeholder engagement

- Further surface sampling

- Geophysical surveys at Crosbie North

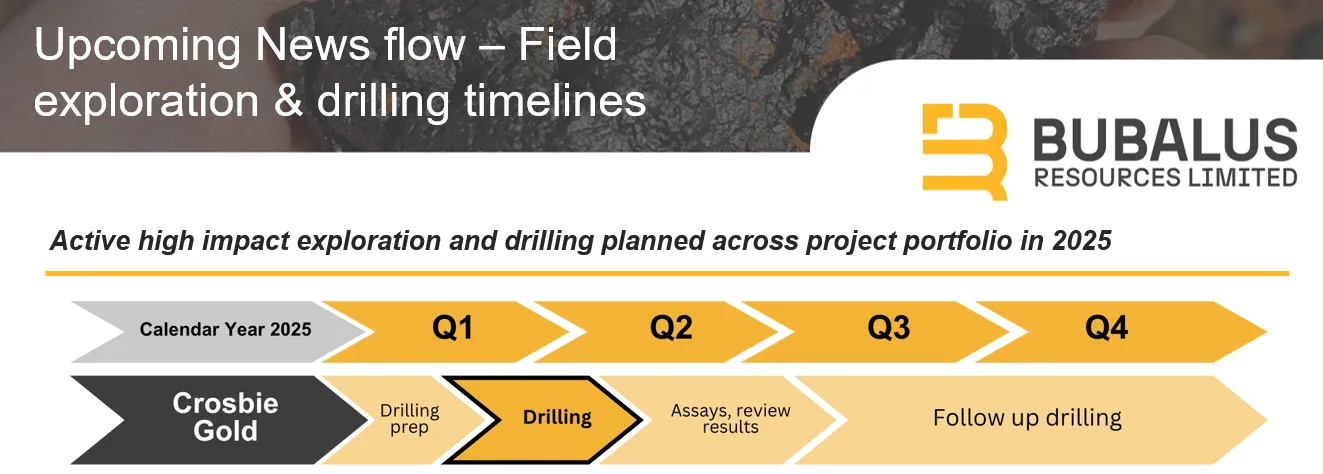

- Drilling program at Crosbie South

- Assay results

- Drilling program at Crosbie North

- Drilling program at Avon Plains

Why We Like Bubalus Resources

Bubalus Resources represents a compelling opportunity in Victorian gold exploration. With its prime position between Fosterville (4.8 g/t gold) and Costerfield (9.8 g/t gold), it’s sitting right in the middle of proven high-grade territory. At a significant discount to peers, BUS combines strategic positioning with immediate drilling potential. The company’s $3.5 million cash position enables rapid advancement of drilling programs in 2024. Gold’s surge toward record highs and China’s antimony export ban have created perfect timing for BUS to test these promising targets.

Why Gold (and Antimony)

Gold’s traditional role as a safe haven has strengthened amid global uncertainty. With geopolitical tensions rising and Western countries eyeing interest rate cuts, experts are forecasting US$3,000/oz in 2025. Meanwhile, China’s recent ban on antimony exports to the USA has sent prices soaring 250%, adding a compelling second commodity to the BUS story. This critical metal, essential for everything from semiconductors to flame retardants, provides valuable diversification.

Bubalus Resources' Position in Victoria

What makes BUS’ position special is the combination of location and geology. The company’s Crosbie target sits in Victoria’s renowned Bendigo zone, where geological features mirror those of the successful Fosterville mine. Recent surveys have identified exposed granite connected with underground chargeability anomalies – exactly what you want to see before drilling.

The Key Points of Interest

BUS’ strategy mirrors successful Australian gold plays – secure ground between proven mines and fast-track exploration. The company’s position between Fosterville and Costerfield provides potential for significant discoveries, with existing infrastructure nearby potentially accelerating any future development.

Bubalus in Summary

At an $8 million market cap, BUS offers leveraged exposure to both gold and antimony. While early-stage exploration carries inherent risks, the combination of proven high-grade territory, drill-ready status, and experienced local leadership creates a compelling investment case. The upcoming drilling program could prove transformational for BUS shareholders.

Disclaimer: This blog post is for informational purposes only and should not be considered as financial advice. Always consult with a financial advisor before making any investment decisions.