Top End Energy Articles

TEE Share Price & Investment Performance

Investment Summery

- Date of Investment Announcement 2nd December 2024

- Entry Price $0.10

- Returns from Entry -66%

- High Point 30%

Company Milestones

- Initial investment: $0.10

- Increase land average

- Seismic survey

- Drill contractor award

- Drill targets

- Flow test

- Resource definition

Why We Like Top End Energy

Top End Energy represents a compelling opportunity in natural hydrogen exploration. With its prime Kansas position next to massive players backed by Bill Gates, Jeff Bezos, Andrew Forrest and Vinod Khosla, it’s sitting right in the middle of where the smart money is flowing.

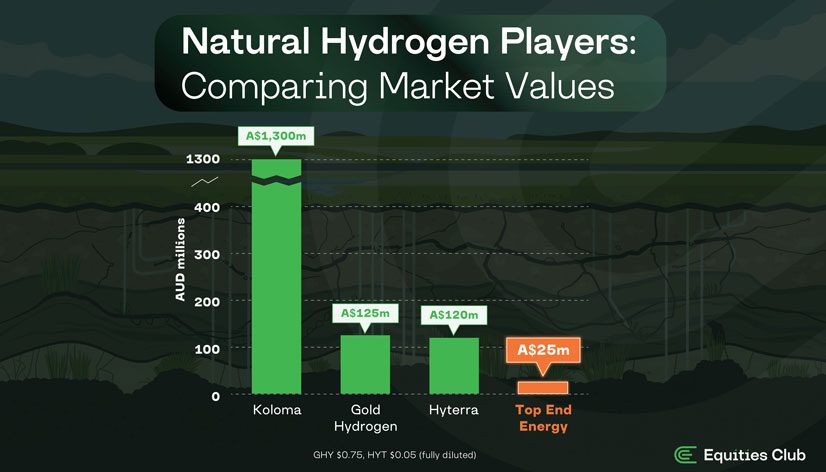

At a significant valuation discount to peers, TEE combines strategic positioning with compelling economics. The company’s recent $6 million raise enables acceleration of land acquisition and technical studies ahead of planned drilling in 2025. Natural hydrogen’s emergence as the cheapest form of clean energy production has attracted over billions of dollars in investment as mining and tech leaders flock to the region.

Why Natural Hydrogen?

Natural hydrogen represents a paradigm shift in clean energy production. Unlike manufactured hydrogen, which requires billions in infrastructure and energy-intensive processes, natural hydrogen forms continuously underground through geological processes. The economics are compelling – it’s the cheapest form of hydrogen to produce, using conventional gas drilling techniques at shallower depths. While green hydrogen projects struggle with massive infrastructure costs, natural hydrogen offers a path to clean energy production using proven extraction methods.

Top End Energy's Kansas Position

What makes TEE’s position special is the combination of location and timing. The company’s 20,000 acres sit in Kansas’s natural hydrogen heartland, where historical drilling has already identified hydrogen seeps. With five active explorers currently fighting for permits and major energy players joining USGS research efforts, TEE’s early-mover advantage in this emerging hub is significant.

The Key Points of Interest

TEE’s strategy mirrors successful early-stage resource plays – secure prime land ahead of the rush and prepare for systematic exploration. The company’s position next to High Plains Resources/Koloma (backed by Gates and Bezos) and HyTerra (backed by Forrest) provides potential for district-scale development.

Top End Energy in Summary

At a $25 million market cap, TEE offers leveraged exposure to natural hydrogen’s emergence as a major energy source. While early-stage exploration carries inherent risks, the combination of prime Kansas position, extraction methods similar to gas, and backing from sophisticated investors creates a compelling investment case. The next 12 months of land acquisition and technical work could prove transformational for TEE shareholders.

Disclaimer: This blog post is for informational purposes only and should not be considered as financial advice. Always consult with a financial advisor before making any investment decisions.