Fortuna Metals (ASX: FUN) has wasted no time post-acquisition, with soil sampling completed and auger drilling underway at its Mkanda and Kampini projects in Malawi.

FUN, valued at $21 million, has already identified visible rutile, with the first laboratory results due in November.

For new readers, Fortuna is the junior we added to our Equities Club portfolio last week, drawn to its ground position and exposure to commodities with tightening supply.

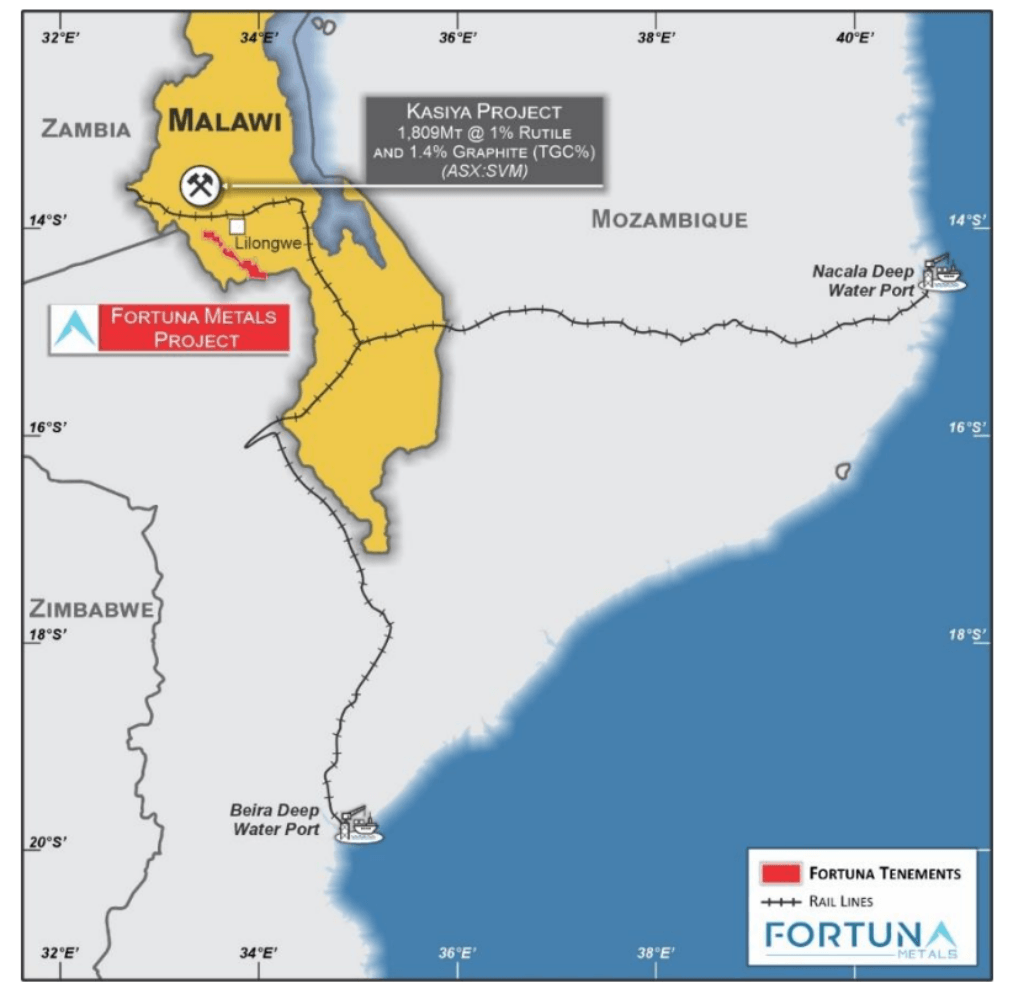

Covering 658 square kilometres in the same geological belt as the $550 million Sovereign Metals’ (ASX: SVM) world-class Kasiya deposit, FUN’s ground sits in a province that is rapidly emerging as a new hub for rutile and graphite.

When we added FUN to our portfolio, it more than doubled intraday before settling higher on strong volume. The stock has since found a level at 11c, showing how quickly investors understood the story.

FUN remains cheap despite the early move. It’s parked right next to one of the biggest rutile finds on the planet, and demand is heating up at the same time.

“It has been a great achievement by the in-country team to be completing our phase one works as quickly and efficiently as we have done.”

– Fortuna Metals CEO Tom Langley

Fortuna Metals (ASX: FUN) advances Malawi rutile exploration

The Next Door Neighbours in Malawi – Sovereign Metals

FUN sits along the same geological strike as Kasiya, where SVM found the world’s largest rutile and second-largest graphite resource.

Number 1 shareholder Rio Tinto owns a beefy 18.5% of SVM, which tells you plenty about how the majors view this belt.

FUN is exploring the same Lilongwe Plain formation as SVM, where tropical weathering has pushed rutile close to surface. What that means is the company is not chasing an untested idea but drilling in proven mineralised terrain.

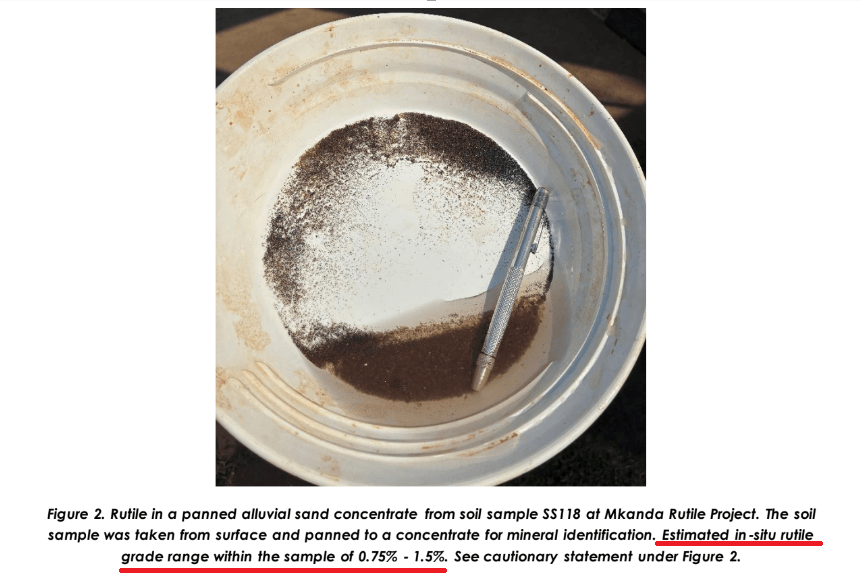

Early soil sampling work and auger drilling have already pulled visible rutile grains from the pan, with estimated in-situ grades of 0.75–1.5%.

For comparison, Sovereign is capped at $550M on the back of a billion-tonne resource grading just over 1%. If Fortuna proves even a fraction of that scale, an 11c share price leaves plenty of headroom.

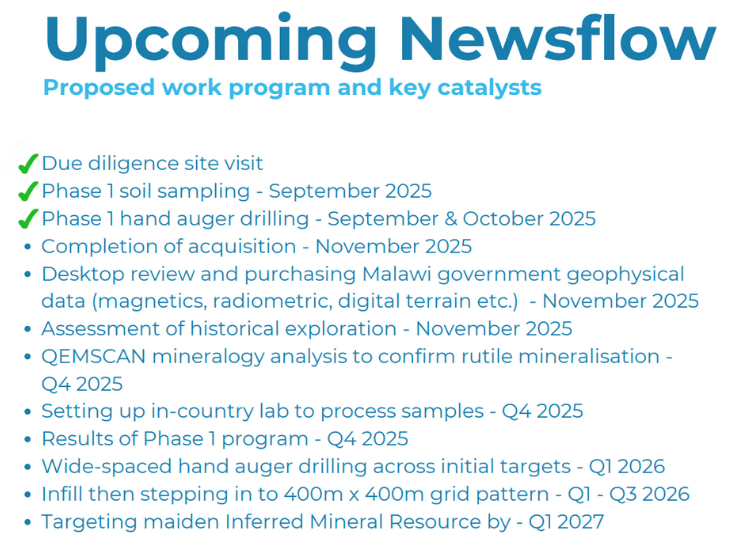

358 soil samples are already en route to South Africa for lab testing, with results expected from November. That sets up steady news flow into year-end, and a short wait for potentially large gains.

Japan Backs Malawi Rutile Corridor with US$7B

Less than two weeks ago, Japan announced a US$7 billion initiative to develop the Nacala Corridor, the preferred export route for SVMs’ Kasiya project.

Japan has validated SVM’s product for high-performance titanium markets, a burgeoning market.

Why this matters for FUN is that if the company can confirm a rutile discovery, it gets the same infrastructure backing without having to prove the export economics from scratch.

Logistics are often the biggest hurdle for African explorers. Yet, this corridor development could provide a reliable, low-cost pathway to international markets.

Japan’s move removes a major future risk. It means that any discovery by FUN is now more likely to be commercialised, connected to demand, and positioned in a strategically supported supply chain.

Natural Rutile vs Synthetic: The Emissions Edge

Rutile is critical to the production of titanium dioxide, used everywhere from paint pigments to jet engines and increasingly in robotics. As the robotics revolution accelerates, natural rutile supply is tightening while established deposits deplete.

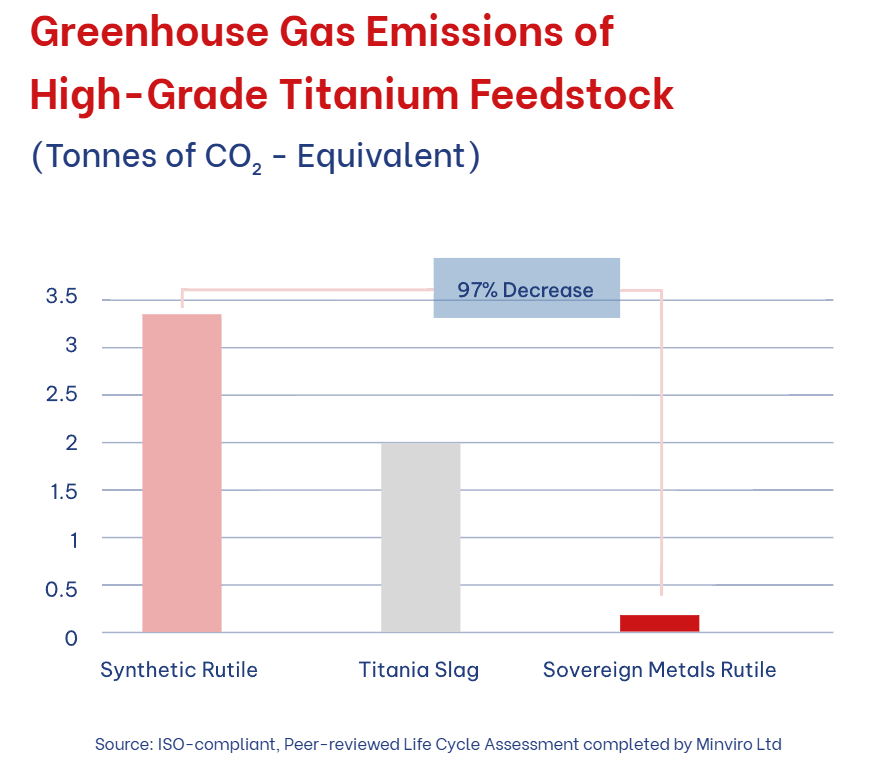

Bridging the gap in the interim is synthetic rutile, producing 30 times more greenhouse gas emissions than natural rutile, like Sovereign has. This is becoming a real problem as carbon pricing spreads globally and companies face pressure to clean up their supply chains.

Not only is natural rutile from Malawi emerging as a new centre of production with the world’s largest deposit, but FUN is now positioned early in this supply story.

If FUN can prove up a deposit along strike from SVM, it taps into the same low-emission profile that’s making Sovereign attractive to major buyers.

This translates into exposure to a commodity with strong demand, constrained supply, in a proven location, and increasing strategic importance. That’s why Malawi’s rutile story is only getting louder, and FUN is already in the chorus.

Fortuna Metals Rutile Assays due November

FUN is moving fast in Malawi, with soil sampling done and auger drilling nearly wrapped up, with visible rutile grains showing up already.

Lab results start flowing from November, setting up months of potential catalysts. That’s a short timeline by exploration standards, especially for a stock that’s already shown it can move on good news.

Assays plus reviews of government and historical data will keep the story moving.

FUN found rutile next door to the world’s biggest rutile deposit while the market for rutile tightens, and it has a stream of news flow on the horizon.

True to its ticker, the fun is just getting started.

General advice warningThe contents of this document are intended to provide general securities advice only and have been prepared without taking account of your objectives, financial situation or needs. Because of that you should, before taking any action to acquire or deal in, or follow a recommendation (if any) in respect of any of the financial products or information mentioned in this document, consulting your own investment advisor to consider whether that is appropriate having regard to your own objectives, financial situation and needs. If applicable, you should obtain the Product Disclosure Statement relating to the relevant financial product mentioned in this document (which contains full details of the terms and conditions of the relevant financial product) and consider it before making any decision about whether to acquire the financial product. Whilst the Equities Club Pty Ltd (“Equities Club”) believes information contained in this document is based on information which is believed to be reliable, its accuracy and completeness are not guaranteed and no warranty of accuracy or reliability is given or implied and no responsibility for any loss or damage arising in any way for any representation, act or omission is accepted by Equities Club or any officer, agent or employee of Equities Club or any related company.Neither Equities Club, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice.

Disclosure

The directors, authorised representatives, employees and associated persons of Equities Club may have an interest in the financial products discussed in this document and they may earn brokerage, commissions, fees and advantages, pecuniary or otherwise, in connection with the making of a recommendation or dealing by a client in such financial products. Equities Club owns 1,504,000 shares of FUN at the time of publishing this article. Equities Club has been engaged by FUN at the time of writing.

Equities Club Ltd (CAR No. 001308139) is a corporate authorised representative of ShareX Pty Ltd, Australian Financial Services License (AFSL) No. 519872.