Energy security is having a moment in the US, and Top End Energy (ASX: TEE) has now handed American investors a direct way in.

The natural hydrogen explorer’s shares are now quoted in the US under ticker SERPY, putting the $11 million small-cap in front of American capital for the first time.

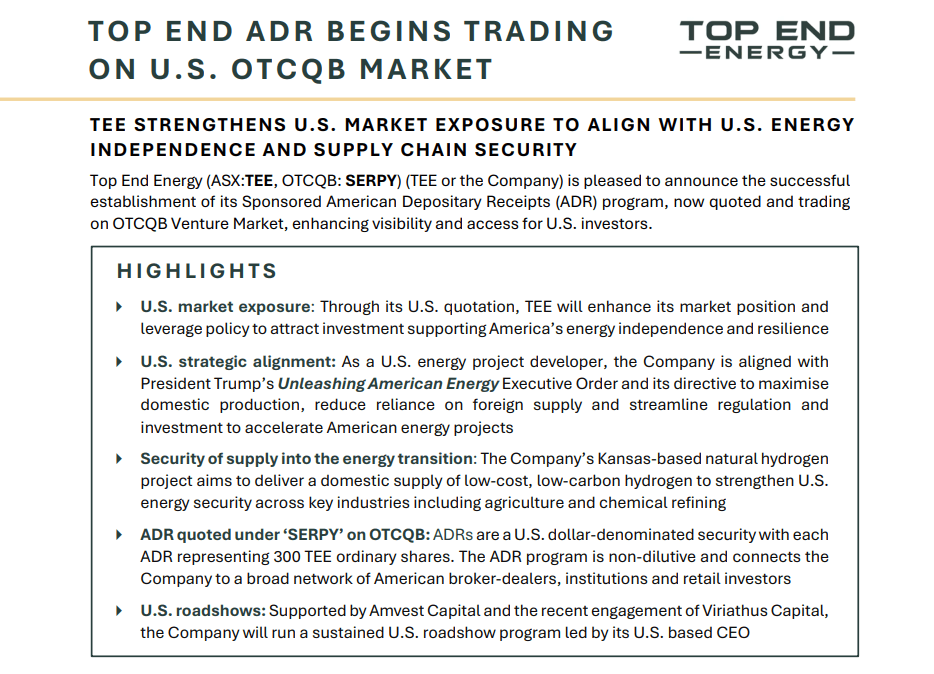

TEE has launched straight onto the OTCQB under ticker SERPY, giving it visibility and access in the US market. US investors can now buy TEE directly, while it keeps its primary listing on the ASX.

They’re also ADRs (basically US receipts for ASX stock), which means no dilution for current holders.

Trump’s energy policies are backing domestic projects, and TEE’s Kansas hydrogen ground now lines up neatly with that push.

TEE’s Kansas Hydrogen Story Hits US Markets

For a junior, the real catalyst often comes from who’s paying attention, rather than what might be in the ground. TEE’s US listing now puts them in front of American capital for the first time.

The over-the-counter market was built for companies like TEE, which are early stage, growth-focused and looking for a foothold in the biggest pool of money in the world.

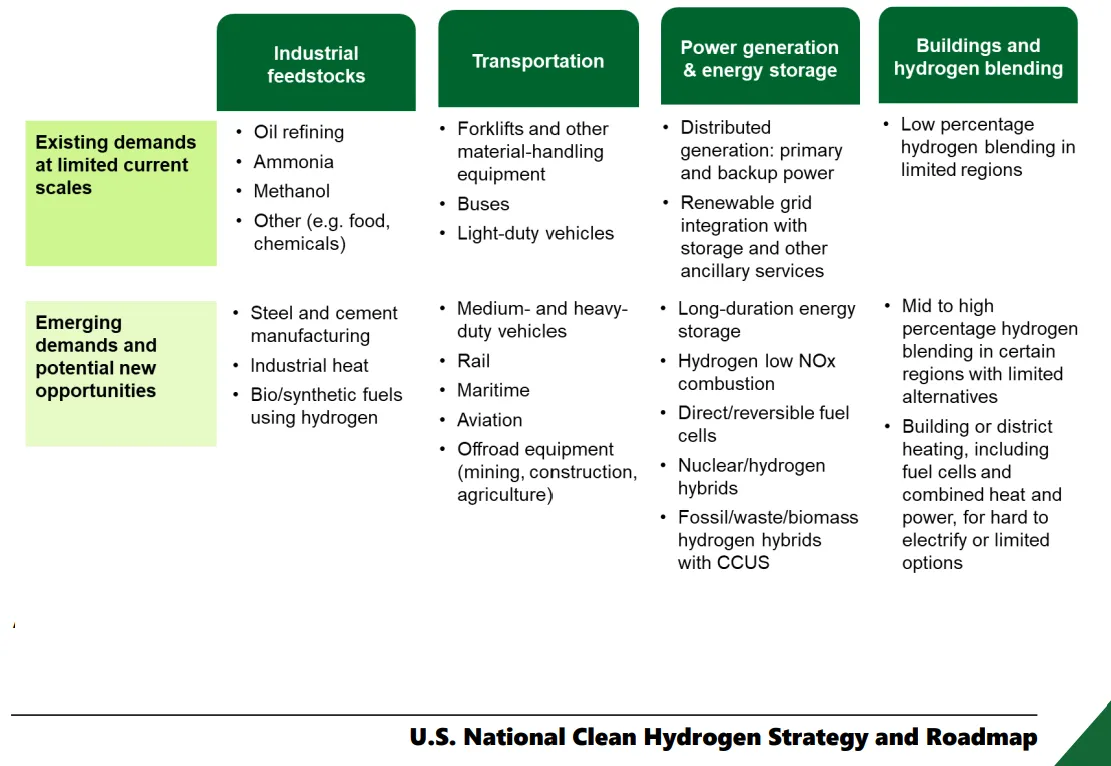

And TEE’s Kansas ground gives it an edge. The company’s acreage sits in the mid-continental rift, a region already buzzing with attention from billionaires and energy majors.

Hydrogen’s role in fertiliser and farming gives Kansas another tailwind, with the agri-belt right on TEE’s doorstep.

TEE’s dual listing means US funds can finally get a piece of the action without jumping through international hoops.

That local connection could make all the difference, US money tends to flow quickest when the project is on home turf.

With America doubling down on domestic energy, TEE now gets to sell itself as a home-grown supplier rather than an overseas opportunity.

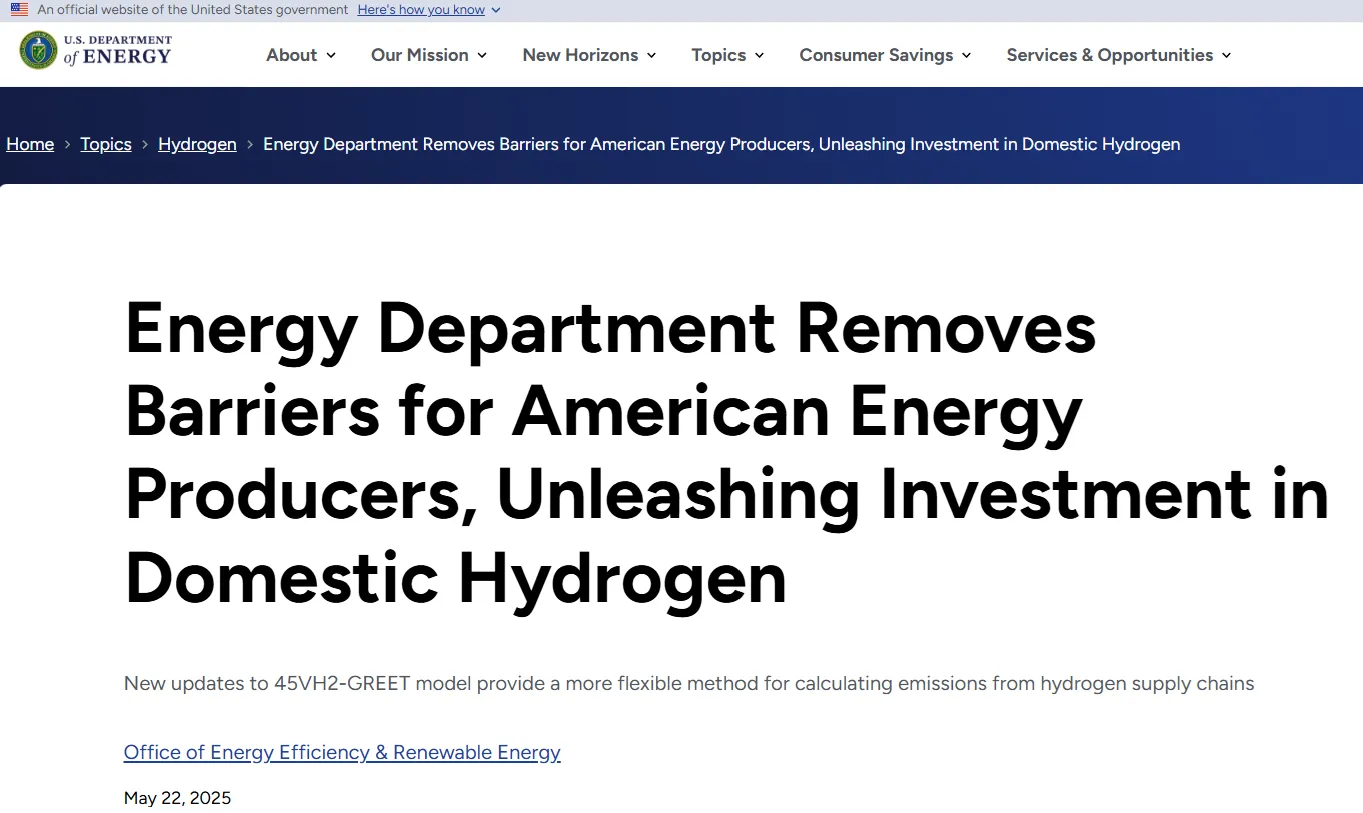

US Energy Policy Winds at Top End Energy’s back

The clue to Trump’s “Unleashing American Energy” order is in the name. It’s about faster permitting, fewer bottlenecks, and a big push for domestic energy investment.

All of which makes life easier for companies like TEE looking to drill.

Investors read policy as much as geology, and when Washington starts backing domestic energy, capital tends to follow.

With a US project, a US listing path and a policy stance geared toward new supply, TEE is positioning itself squarely in the slipstream of those themes.

America Puts its Money Where its Mouth is

Washington is lining up money and policy to anchor supply chains on home soil.

Last week, there were reports Trump is looking at redirecting US $2 billion from the CHIPS Act for critical minerals and energy. It’s a quick way of getting projects moving without waiting on Congress approvals.

In Nevada, the Hawthorne Army Depot is set to host a strategic minerals reserve, a public–private venture designed to stockpile, refine and recycle the resources America wants secured domestically.

On the capital side, the OTC platform has become a key route for international juniors to plug into US money. For TEE, it opens doors to brokers and funds who are hunting for energy stories that fit Washington’s new playbook.

All of it adds up to the strongest US policy and funding backdrop in decades, with Top End Energy stepping onto that stage at the right time.

US Investors Gain Direct Access to Top End Energy

Kansas hydrogen is no longer just an ASX story. With TEE now trading in the US, American investors have a line into a company preparing to drill a project that ticks a lot of Trump’s policy boxes.

With a $11 million market cap and $4 million in cash, TEE has room to move but needs a partner to drill. A US deal would be the real catalyst here.

Natural hydrogen has no benchmarks yet, so first movers stand to be rewarded. The OTC listing gives US investors a seat at the table early, before any deal is struck.

Fresh capital from a domestic partner for a domestic energy project would likely spark a swift re-rate.

Next Steps for Top End Energy’s Kansas Hydrogen Play

Top End Energy’s US listing puts its Kansas hydrogen project on the radar of the investors most likely to fund the next stage.

With 304 billion cubic feet of prospective hydrogen resources and farm-out talks already on the table, more pieces are falling into place.

It’s a timely move with policy support building, US capital now in reach and the Kansas ground already drawing industry attention.

The next catalyst will be landing that US partner. Pull that off, and an $11M market cap won’t stick around for long.

General advice warning

The contents of this document are intended to provide general securities advice only and have been prepared without taking account of your objectives, financial situation or needs. Because of that you should, before taking any action to acquire or deal in, or follow a recommendation (if any) in respect of any of the financial products or information mentioned in this document, consulting your own investment advisor to consider whether that is appropriate having regard to your own objectives, financial situation and needs. If applicable, you should obtain the Product Disclosure Statement relating to the relevant financial product mentioned in this document (which contains full details of the terms and conditions of the relevant financial product) and consider it before making any decision about whether to acquire the financial product. Whilst the Equities Club Pty Ltd (“Equities Club”) believes information contained in this document is based on information which is believed to be reliable, its accuracy and completeness are not guaranteed and no warranty of accuracy or reliability is given or implied and no responsibility for any loss or damage arising in any way for any representation, act or omission is accepted by Equities Club or any officer, agent or employee of Equities Club or any related company.

Neither Equities Club, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice.

Disclosure

The directors, authorised representatives, employees and associated persons of Equities Club may have an interest in the financial products discussed in this document and they may earn brokerage, commissions, fees and advantages, pecuniary or otherwise, in connection with the making of a recommendation or dealing by a client in such financial products. Equities Club owns 600,000 shares of TEE at the time of publishing this article. Equities Club has been engaged by TEE at the time of writing.

Confidentiality notice

The information contained in and accompanying this communication is strictly confidential and intended solely for the use of the intended recipient/s. The copyright in this communication belongs to Equities Club. If you are not the intended recipient of this communication please delete and destroy all copies immediately.

Equities Club Ltd (CAR No. 001308139) is a corporate authorised representative of ShareX Pty Ltd, Australian Financial Services License (AFSL) No. 519872.