Black Horse Mining Articles

BHL Share Price & Investment Performance

Investment Summery

- Date of Investment Announcement 2nd December 2025

- Entry Price $0.20

- Returns from Entry +0%

- High Point +0%

Company Milestones

- Initial investment: $0.20

- Drilling underway at Mt Egerton

- Historic workings mapped

- Shallow targets drilled

- First assay results

- Deeper drilling program

- Follow up drilling across district

Why We Like Black Horse Mining

Black Horse Mining is stepping onto the ASX with a project that already has serious runs on the board. Mt Egerton produced more than a million ounces back in the 1800s, averaging around 12 g/t, then went quiet for more than a century because the old mining methods hit their limits. The rocks didn’t. With $8 million raised and drilling ready to start immediately, BHL is taking modern tools into a field that has barely been touched since the pumps were turned off in 1906. Province Resources has taken nearly half the register and locked it up for two years, leaving a tight free float and a clean setup for the first round of drilling. The field hasn’t been available to listed explorers for 25 years, having been held privately with limited capital behind it. The appeal is simple: a proven high-grade system that never got a proper second look.

Why Gold

Gold is having another moment. Rates are wobbling, currencies are swinging around, and Australian-dollar gold prices are still sitting comfortably. Explorers with real geology tend to stand out when the bigger picture feels unsettled. Victoria has been the surprise performer of the last decade, with deeper drilling at places like Fosterville, Costerfield and Sunday Creek showing that high-grade positions continue well below the old workings. Victorian deposits also have small surface footprints, low operating costs and some of the best margins in the country because they don’t require moving massive tonnages. Mt Egerton sits in that same story, just without the benefit of modern drilling.

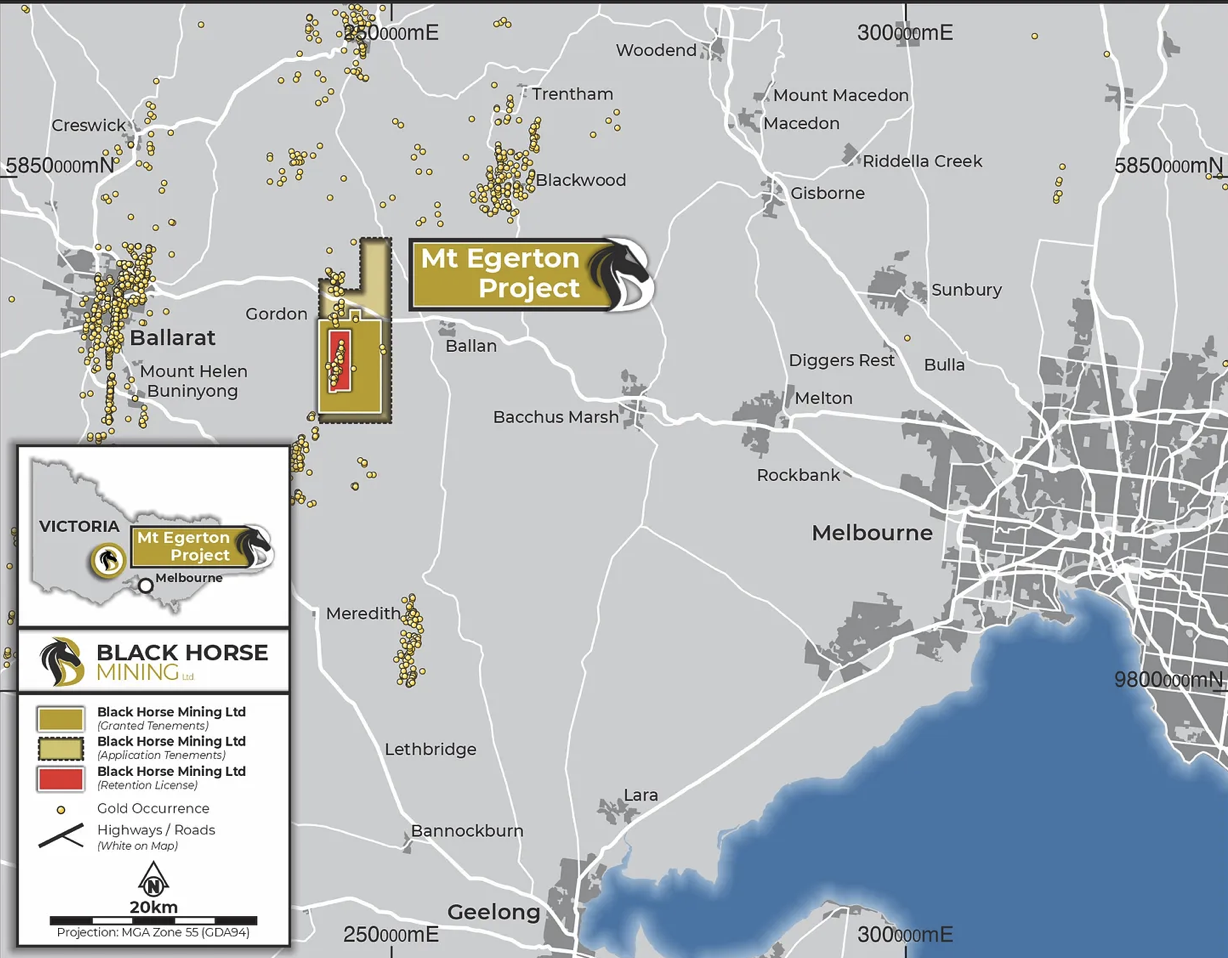

Black Horse Mining's Position in Victoria

Mt Egerton sits west of Melbourne and north of Ballarat, tucked inside one of the most productive gold belts in the state. The old miners pulled more than a million ounces out of the field, yet most of the drilling done since has barely scratched past 150 metres. Beneath the last stopes, the workings are still open. The deeper levels down to roughly 550 metres were only abandoned because pumps failed and capital dried up, not because the system was mined out. To the east, there are small lines of historic shafts that were barely explored because the original owners had different priorities. There are hundreds of pits and small shafts tracking those parallel trends, showing gold-bearing structures that were never tested with proper drilling. It’s the kind of ground where a few well-placed holes can change the scale of the whole story.

The Key Points of Interest

BHL’s first year is all about building that picture. They’ll map the old shafts properly, run ground-penetrating radar, fly new magnetics across the Egerton trend and the parallel structures, and then start dropping diamond holes into both shallow positions and deeper targets. The historical numbers are worth a fresh look: 7m at 18 g/t, 4m at 26 g/t, 10m at 10 g/t, 5m at 11 g/t, and several others with proper grade. None of it has been followed down-plunge with modern rigs. There’s room for repeats along strike as well. Several near-surface shoots were likely missed entirely because the old miners hit faults and simply lost the lode, leaving unmined positions only metres away from historic stopes. That same structural complexity is what allowed Southern Cross to grow its Victorian project into a multibillion-dollar company, and Mt Egerton shares the same geological architecture. It’s rare to get this much history with this little modern drilling.

Black Horse Mining in Summary

BHL is listing with a straightforward plan: drill a proven goldfield that never got a proper modern run. The register is tight, the cash is there, and the geology already has a long record of high-grade production. The company already has its notifications lodged, meaning a drill rig can start turning from day one. The early focus is on shallow unmined shoots, followed by deeper positions where Victorian systems often improve in grade. It’s still early-stage exploration, and results will do the talking, but Mt Egerton gives BHL a genuine shot at finding what the old timers couldn’t reach. For anyone watching the next wave of Victorian gold stories, this one sits right in that pocket.

Disclaimer: This blog post is for informational purposes only and should not be considered as financial advice. Always consult with a financial advisor before making any investment decisions.